how much will my credit score increase with a car loan

Either negotiate changes or walk away. Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score altogether.

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

This is especially the case if youre well above a lenders score requirement for the best credit terms.

. Instantly increase your credit scores for free. The information contained in Ask Experian is for educational purposes only and is not legal advice. A few months later with my credit score comfortably in the low 800s I decided to push my luck and ask for another credit line increase.

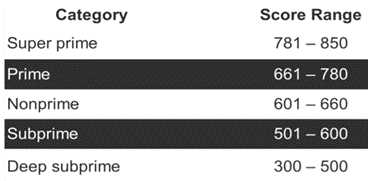

A credit score can range from 300 to 850 depending on the scoring model such as a mortgage score. Auto loans for bad credit. Here are a few reasons why your score might drop when you pay off a loan.

Any time you make a major change to your credit history like adding or closing an account your score may drop slightly. You should consult your own. For example if you have a 5000 balance and your total credit limit is 20000 your ratio is.

You apply for a loan and the banklendercredit union makes a hard inquiry. Credit score calculated based on FICO Score 8 model. Vehicles must be purchased from Carvanas inventory.

Typically these are treated as a single inquiry and will have little impact on your credit scores. You apply for the next one and the process repeats again 5-10 points down. The Experian report shows that only 037 of new-car loans and 435 of used-car loans issued in the fourth quarter of 2019 went to people with credit scores of 500 or lower.

All the calculation and examples below are just an estimation. 0 owed on a card with a 1000 limit is. Maxing out your credit cards can cause your credit score to take a hit even if you pay your balances on time.

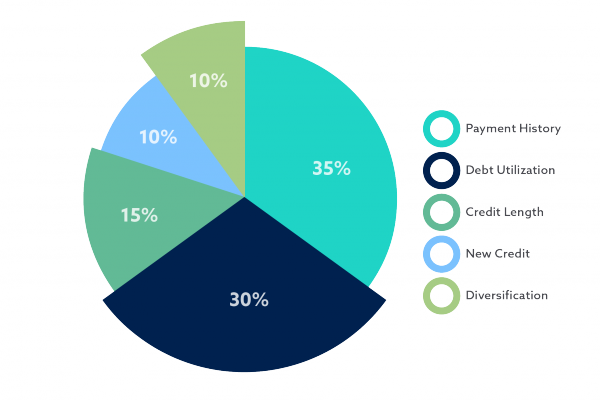

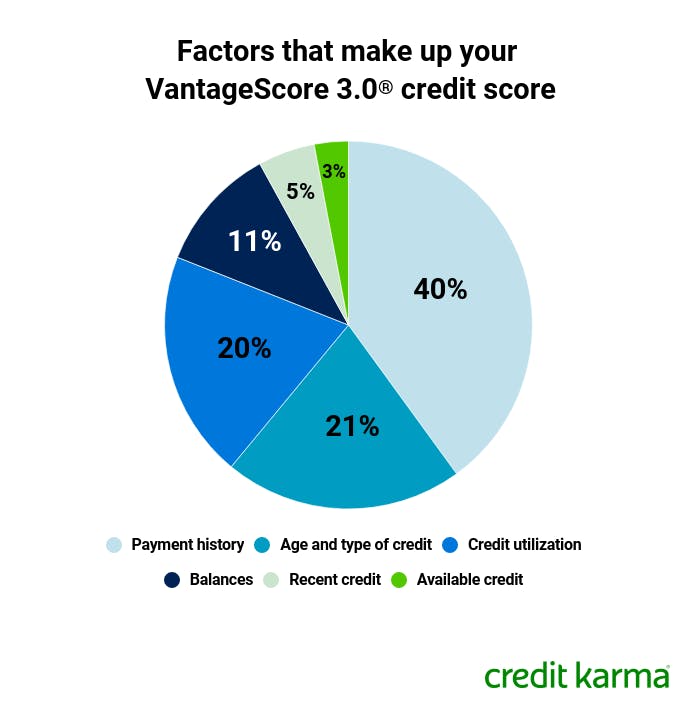

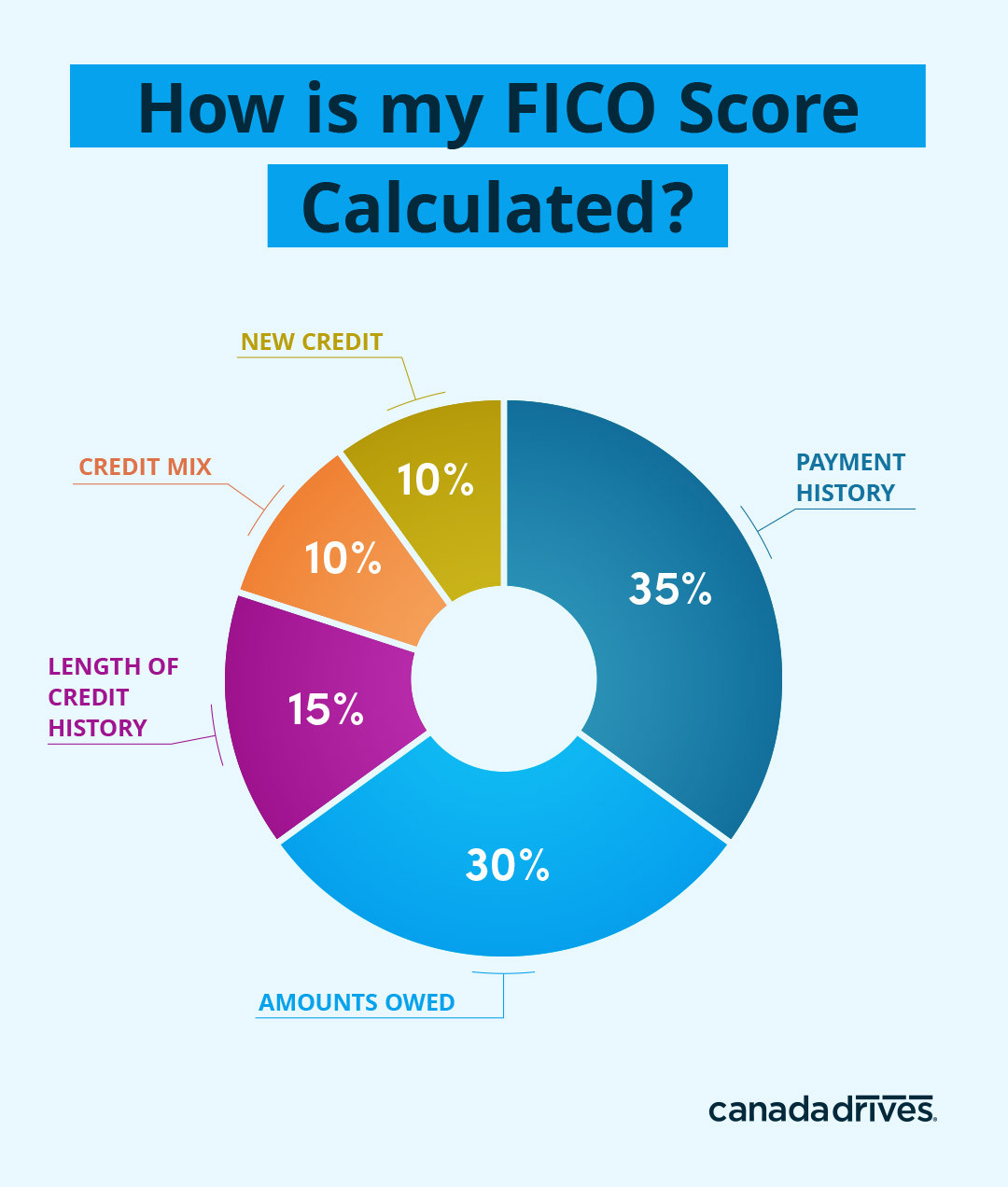

Amounts owed is the second most important category used to calculate your FICO credit. Credit scores usually range from 300 to 850 with scores of 670 and up considered good to excellent. Doe were in the market for a new home and needed a mortgage lender in the month of October.

Your credit score drops from 5 to 10 points. Here are some of our picks for lenders that offer car loans for bad credit. In most cases there isnt much equity in a car loan so taking cash out might increase the risk of being upside down on the loan owing more than the car is worth.

If the loan isnt what you expected or wanted dont sign. Similar to a car loan. By removing the financial and emotional weight of student loan debt you are free to reimagine your finances.

With secured credit cards the card issuer asks you to make a deposit in exchange for a new card with a credit limit equal to or close to the amount of cash you deposited with the lender. Looking for new credit can equate with higher risk but most Credit Scores are not affected by multiple inquiries from auto mortgage or student loan lenders within a short period of time. While theres no universal minimum credit score required for a car loan your scores can significantly affect your ability to get approved for a loan and the loan terms.

How much will credit inquiries affect my score. Because your utilization is a ratio of how much you owe versus how much available credit you have its important to keep your credit cards open. Getting a car loan with a credit score of 500 could be tough too.

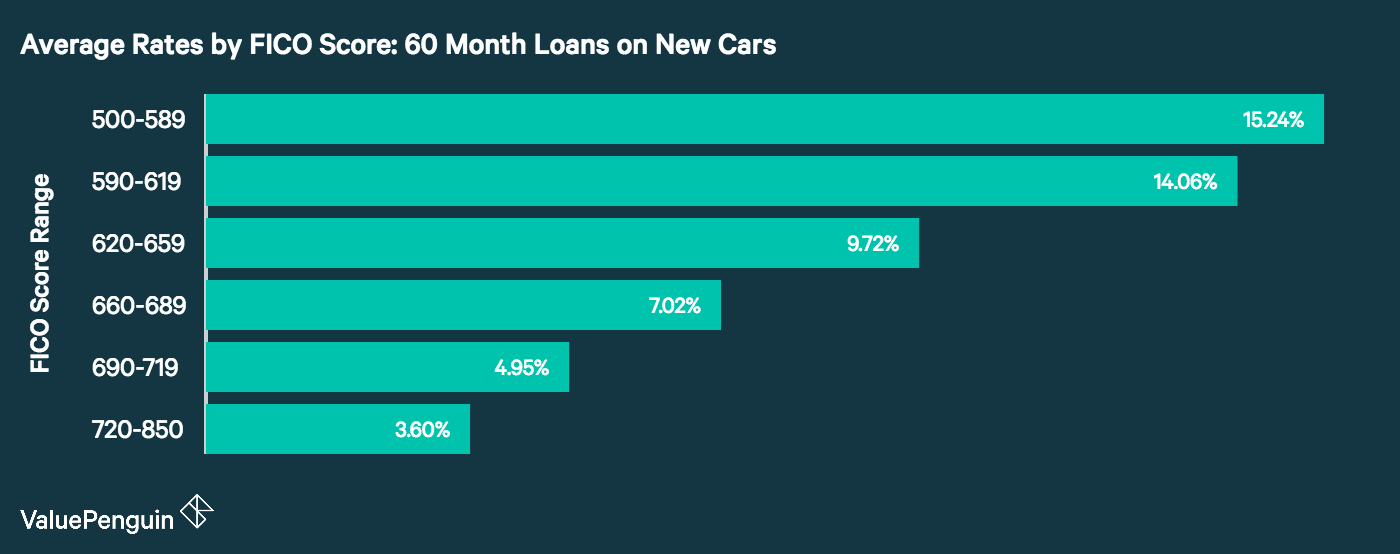

As soon as the account was updated to paid loan on my credit my FICO Score dropped by 4-6 points depending on which of the three credit bureaus I checked. Car truck minivan or SUV for personal use. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the Q2.

Youll need to make sure you dont miss loan or credit card payments by more than 29 dayspayments that are at least 30 days late can be reported to the credit bureaus and hurt your credit scores. There are steps you can take to increase your credit score and the sooner you address certain factors the faster your credit score will go up. Your credit utilization ratio measures how much credit you use versus how much you have available.

Their credit score was 678 but to receive the best rates a 740 or above is needed. Best car loans for bad credit. Carvana is an online used-car dealer that will sell you a car finance your purchase and deliver it to your door.

Credit mix isnt addressed by typical credit cards. Without a better credit score the mortgage would cost them an additional 4500 on a 200000 loan amount. Paying Off a Loan May Lead to a Temporary Score Drop.

To be clear every situation is. Free Dark Web Scan. In about 15 minutes I increased my.

Before you sign read the loan closing papers carefully. Individuals with a 800 FICO credit score pay a normal 34 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 500-589 were charged 148 in. The safest and cheapest way to purchase a car and pay it off later is to shop around for an auto loan with a low interest rate.

If you default on a secured card the issuer will keep your security deposit to. If you are facing a premium increase upon your next policy renewal shopping for a new. Someone with good credit may qualify for as low as 0.

Carvana has no minimum credit score but will look at your full credit profile before making a financing decision. Credit scores that fluctuate by a few points up or down wont have a big effect on your ability to get approved for a loan or credit card. Again it was instant.

Credit Score Increase of 42 Points. Federal student loan interest rates increase makes borrowing college money more expensive 0404. Your score may take a temporary hit when you pay off your car loan but if youve managed the loan responsibly up until that point you shouldnt have too much to worry about.

Car loan refinancing guide. It all depends on your overall credit profile and the type of credit score youre checking. You also generally have the right to cancel a home equity loan on your principal residence for any reason and without penalty within three days after signing the loan papers.

So for example if you deposited 500 with the issuer you may get a secured card with a 500 credit limit. Having both loan and card payments on your credit report improves your credit mix which makes up 10 percent of your FICO credit score. Paying off student loan debt can affect much more than your credit score.

For some people paying off a loan might increase their scores or have no effect at all. First it might knock your credit score down.

How To Get A Car Loan With Bad Credit Forbes Advisor

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Credit Repair

Credit Score Needed To Buy A Car In 2021 Lexington Law

What Is The Minimum Credit Score For A Car Loan 2022

What Is Considered Bad Credit Legacy Auto Credit

What Is Considered A Good Credit Score Good Credit Score Good Credit Credit Score Infographic

Getting Affordable And Reliable No Credit Car Loans Can Be Really Tricky However This Is A Completely Simple Proced Loans For Bad Credit Car Loans Bad Credit

How To Get A Car Loan With Bad Credit Credit Karma

What S The Minimum Credit Score For A Car Loan Credit Karma

Average Auto Loan Interest Rates Facts Figures Valuepenguin

What S The Minimum Credit Score For A Car Loan Credit Karma

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Improve Credit

Does Financing A Car Build Credit

Decoding The Factors That Determine Your Credit Score Infographic Daily Info Credit Score Infographic Good Credit Credit Repair

What Minimum Credit Score Do You Need To Buy A Car Nerdwallet